Timbrado de Nómina 3.3 y 4.0

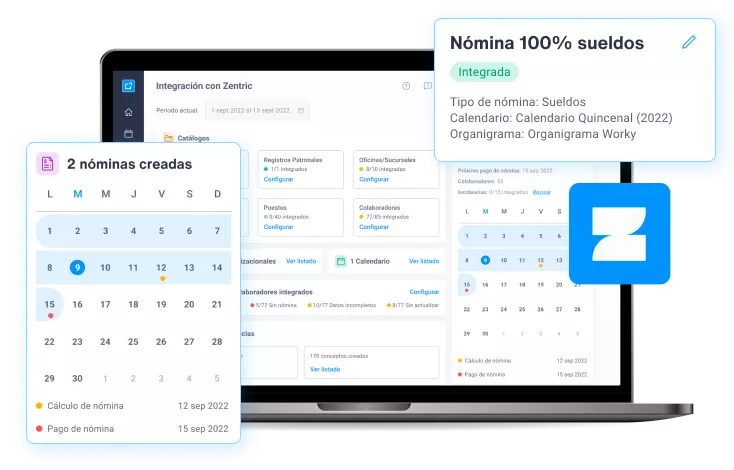

Simplifica tus procesos de cálculo de nómina, distribuye los recibos a los colaboradores y mantén la legalidad del timbrado con la integración Worky + Zentric, el mejor sistema de nómina de México.

Zentric automáticamente te timbra los recibos en las dos versiones, 3.3 y 4.0

Lo básico que debes saber acerca de timbrado de nómina 3.3 y 4.0

¿Qué es el timbrado de nómina?

El timbrado de nómina es un proceso obligatorio en algunos países, como México, que consiste en la validación electrónica de la información contenida en la nómina de los trabajadores de una empresa.

Este proceso se realiza a través del Servicio de Administración Tributaria (SAT) u otra entidad gubernamental similar, y tiene como objetivo garantizar que la empresa cumpla con sus obligaciones fiscales y laborales, así como proteger los derechos de los trabajadores.

El timbrado de nómina implica la emisión de un comprobante fiscal digital por internet (CFDI), que es un documento electrónico que contiene información detallada sobre la nómina de los trabajadores, incluyendo el monto de los salarios, las deducciones y las contribuciones fiscales y de seguridad social correspondientes.

¿Qué diferencias existen entre el timbrado de nómina versión 3.3 y 4.0?

En México, el Servicio de Administración Tributaria (SAT) ha implementado diferentes versiones del timbrado de nómina para mejorar la eficiencia y precisión en la emisión de comprobantes fiscales digitales por internet (CFDI). A continuación, se presentan las principales diferencias entre el timbrado de nómina versión 3.3 y 4.0:

- Estructura del CFDI: La versión 3.3 utiliza una estructura de datos basada en el estándar del comprobante fiscal digital (CFDI) versión 3.2, mientras que la versión 4.0 utiliza la estructura de datos del CFDI versión 3.3.

- Nuevos campos y validaciones: La versión 4.0 incluye nuevos campos y validaciones que no existen en la versión 3.3, como la Clave de Unidad de Medida de acuerdo al nuevo catálogo del SAT, la obligatoriedad de la descripción de los conceptos de la nómina y el cálculo automático del ISR (Impuesto Sobre la Renta) anual para los trabajadores.

- Esquema de cancelación: El esquema de cancelación de la versión 4.0 es más riguroso y limita el plazo para la cancelación de los CFDI, mientras que en la versión 3.3 se permitía la cancelación de CFDI sin importar la fecha de emisión.

- Complemento de nómina: En la versión 4.0, el complemento de nómina se ha modificado y es más completo y detallado, permitiendo la inclusión de información adicional como la fecha de inicio de la relación laboral, el tipo de contrato, el régimen fiscal y la jornada laboral.

Lo básico que debes saber acerca de timbrado de nómina 3.3 y 4.0

En México, existen varios motivos por los cuales una empresa debe actualizar el timbrado de su nómina a la versión 4. Algunas de las razones más comunes son:

Requisito legal: La actualización al timbrado de nómina versión 4 es un requisito legal establecido por el Servicio de Administración Tributaria (SAT). A partir del 1 de enero de 2022, todas las empresas que emiten nóminas están obligadas a utilizar la versión 4 del timbrado de nómina.

Cambios fiscales: La versión 4 del timbrado de nómina incluye cambios fiscales significativos que deben ser adoptados por las empresas para cumplir con sus obligaciones fiscales. Por ejemplo, la versión 4 incluye nuevos campos y validaciones, así como un esquema de cancelación más riguroso.

Mejora en la calidad de la información: La versión 4 del timbrado de nómina proporciona una mayor transparencia y claridad en la relación laboral entre el trabajador y la empresa. El complemento de nómina es más completo y detallado, permitiendo la inclusión de información adicional como la fecha de inicio de la relación laboral, el tipo de contrato, el régimen fiscal y la jornada laboral.

Evitar sanciones: La falta de actualización del timbrado de nómina puede resultar en sanciones y multas por parte del SAT. Por lo tanto, es importante que las empresas actualicen su software de nómina para cumplir con las regulaciones fiscales y evitar posibles sanciones.

¿Cuándo entra en vigor el timbrado de nómina 40?

El timbrado de nómina versión 4.0 ya está en vigor desde el 1 de enero de 2021 para las empresas que así lo deseen, sin embargo, el Servicio de Administración Tributaria (SAT) permitió un periodo de convivencia entre las versiones 3.3 y 4.0 hasta el 31 de diciembre de 2021. A partir del 1 de enero de 2022, la versión 4.0 se convirtió en obligatoria para todas las empresas que emiten comprobantes fiscales digitales por internet (CFDI) de nómina en México.

Es importante que las empresas se aseguren de que su software de nómina esté actualizado a la versión 4.0 para cumplir con las regulaciones fiscales y evitar posibles sanciones y multas por parte del SAT. Además, la actualización al timbrado de nómina versión 4.0 puede mejorar la calidad y transparencia de la información contenida en los CFDI de nómina, proporcionando una mayor claridad en la relación laboral entre los empleados y la empresa.

¿Qué se necesita para timbrar la nómina versión 4.0?

Para timbrar la nómina versión 4.0, se necesitan los siguientes requisitos:

Un software de nómina actualizado: Es importante que la empresa tenga un software de nómina actualizado que sea compatible con la versión 4.0 del timbrado de nómina.

Registro ante el SAT: La empresa debe estar registrada ante el Servicio de Administración Tributaria (SAT) para poder emitir comprobantes fiscales digitales por internet (CFDI) de nómina.

Certificado digital vigente: La empresa debe tener un certificado digital vigente para poder firmar los CFDI de nómina. Este certificado se puede obtener a través del SAT.

Información precisa de los empleados: Es importante que la empresa cuente con la información precisa de los empleados, como su número de seguridad social, su salario y su régimen fiscal.

Conocimiento de las regulaciones fiscales: La empresa debe tener un conocimiento adecuado de las regulaciones fiscales que rigen la emisión de los CFDI de nómina, para poder cumplir con sus obligaciones fiscales y evitar sanciones por parte del SAT.

¿Cómo Timbrar Nómina en el SAT 2023?

El proceso para timbrar la nómina en el SAT en 2023 sigue siendo similar al de años anteriores. Para realizar el timbrado de nómina en el SAT en 2023, sigue los siguientes pasos:

- Regístrate ante el SAT: Si aún no estás registrado en el SAT, debes hacerlo para poder emitir comprobantes fiscales digitales por internet (CFDI) de nómina. Para registrarte, debes ingresar a la página web del SAT y seguir los pasos indicados.

- Obtén un certificado digital: El certificado digital es necesario para firmar los CFDI de nómina. Puedes obtenerlo en la página web del SAT.

- Genera los CFDI de nómina: Para generar los CFDI de nómina, debes contar con un software de nómina actualizado que sea compatible con el timbrado de nómina versión 4.0. Este software te permitirá generar los CFDI de nómina en formato XML.

- Envía los CFDI de nómina al SAT: Una vez generados los CFDI de nómina, debes enviarlos al SAT a través de su portal en línea. Para hacerlo, debes ingresar con tu registro y seguir los pasos indicados.

- Recibe el timbre fiscal: Si los CFDI de nómina son validados correctamente por el SAT, se te enviará un timbre fiscal que deberás incluir en los CFDI de nómina antes de entregárselos a tus empleados.

¿Qué Pasa si no uso CFDI 40?

Si no utilizas el Comprobante Fiscal Digital por Internet (CFDI) versión 4.0 para el timbrado de nómina, estarás incumpliendo con las regulaciones fiscales vigentes en México. El uso del CFDI versión 4.0 para la emisión de nóminas es obligatorio desde el 1 de enero de 2020 y el SAT ha establecido sanciones para las empresas que no lo cumplan.

Las sanciones por incumplimiento pueden variar desde multas hasta la suspensión temporal de la actividad económica de la empresa, según lo establecido en el Código Fiscal de la Federación. Además, el no cumplir con las obligaciones fiscales puede generar problemas legales y financieros que afecten la reputación y la estabilidad económica de la empresa.

Es importante tener en cuenta que el CFDI versión 4.0 permite una mayor transparencia y una mejor fiscalización por parte de las autoridades, por lo que su uso no solo es una obligación, sino que también puede ser beneficioso para la empresa al brindar mayor certeza en sus operaciones. Por tanto, es recomendable que las empresas cumplan con esta obligación fiscal y actualicen sus procesos de timbrado de nómina a la versión 4.0.

¿Qué Pasa si no se Timbran los Recibos de Nómina?

El no timbrar los recibos de nómina puede tener consecuencias negativas para la empresa y los empleados, ya que se estaría incumpliendo con las obligaciones fiscales y laborales establecidas en la ley.

En primer lugar, la falta de timbrado de los recibos de nómina puede generar problemas fiscales, ya que el SAT tiene la facultad de realizar auditorías y verificar el cumplimiento de las obligaciones fiscales de las empresas. Si se detecta que no se han emitido los recibos de nómina o que no se han timbrado correctamente, se pueden imponer sanciones económicas y la obligación de regularizar la situación ante el SAT, lo que podría implicar costos adicionales para la empresa.

Por otro lado, la falta de timbrado de los recibos de nómina también puede generar problemas laborales, ya que los empleados podrían exigir el pago de los salarios que no se han registrado y que no cuentan con los recibos de nómina correspondientes. Además, en caso de que se presenten conflictos laborales o se inicie un proceso legal, los recibos de nómina son una prueba fundamental para demostrar los pagos realizados a los trabajadores.